Ready to get certified? Click here to begin: TAKE THE CERTIFICATION

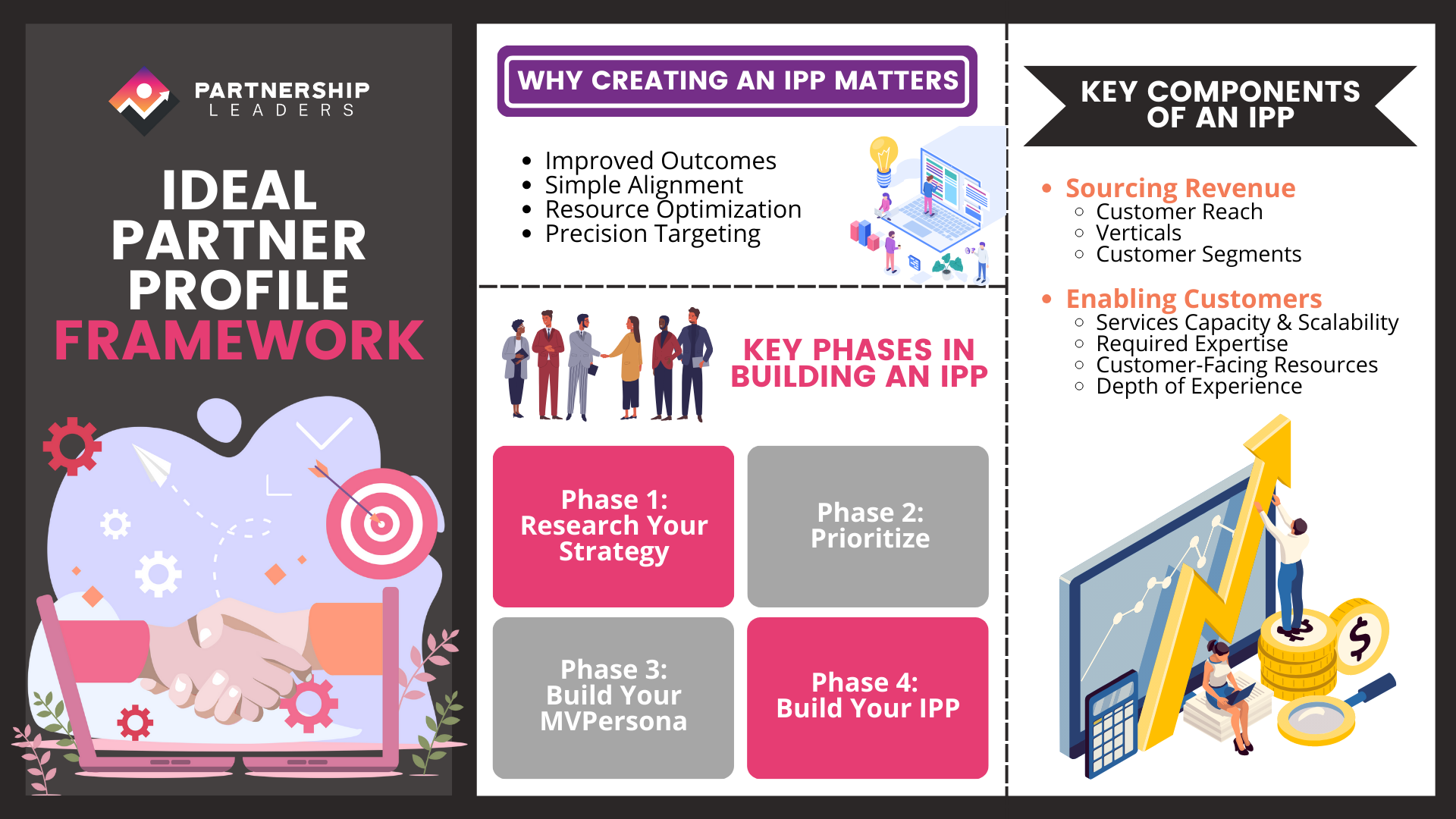

Why Creating an IPP Matters

A solid Ideal Partner Profile (IPP) gets you the right partners and ensures your efforts align with your company goals and customer needs.

Here’s why you need one:

- Improved Outcomes: Identifying the most critical items and focusing your strategy on them will dramatically increase the performance of your organization.

- Simple Alignment: IPPs drive partnerships that make sense. Internal Sales, Success, Product, and Marketing will easily understand the reason for partnering.

- Resource Optimization: IPPs save you time and energy. Stop wasting resources on bad fits and double down on successful partnerships.

- Precision Targeting: IPPs help your team find partners who matter. No more casting a wide net—give them a hunting license for partners who fit your vision and needs.

Key Phases in Building an Ideal Partner Profile

Here’s how to create your Ideal Partner Profile (IPP). Get it right, and you’ll target the right partners and drive results.

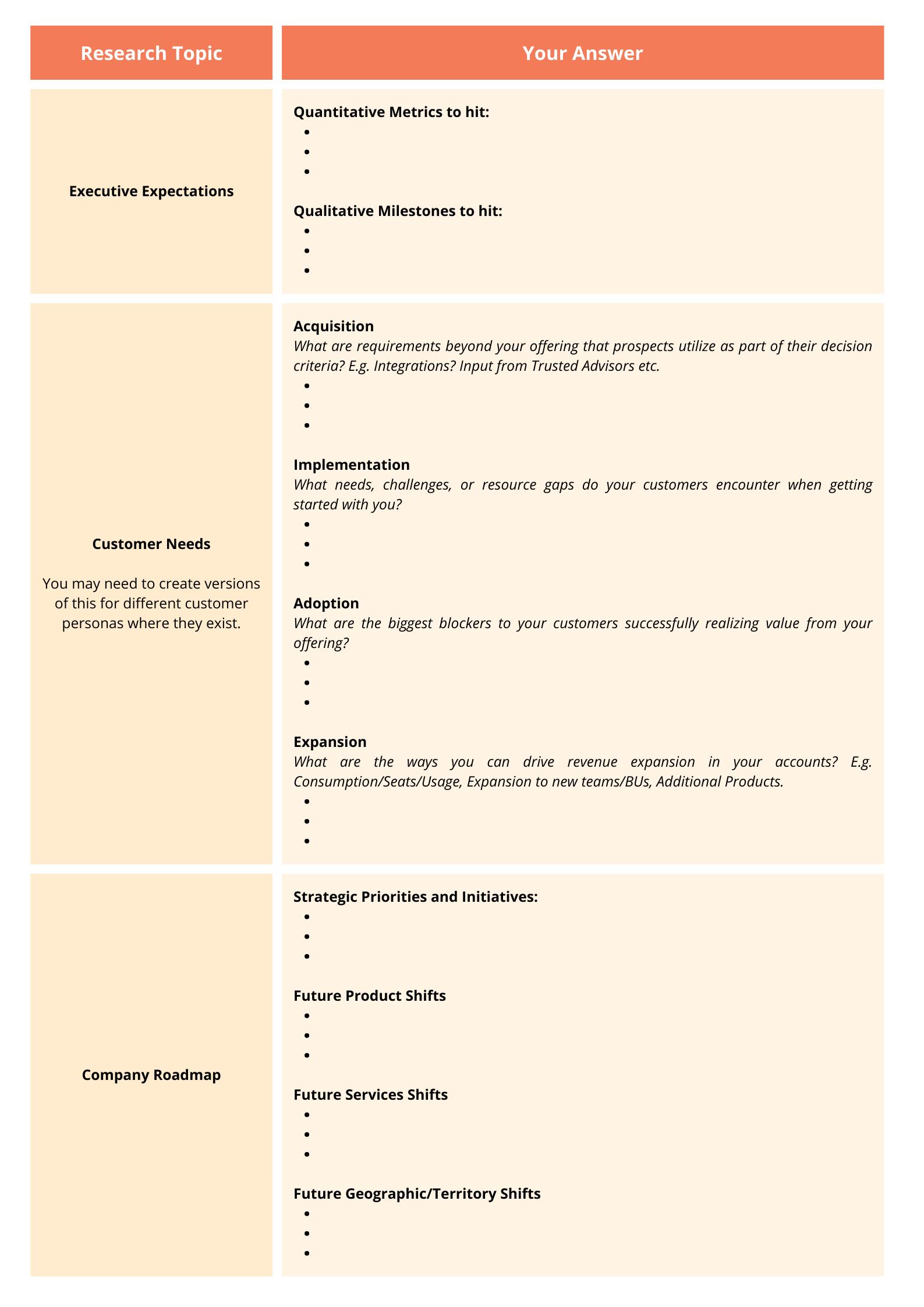

Phase 1: Research Your Strategy

- Executive Expectations – Understanding executive expectations will help the IPP optimize to drive these outcomes.

- Company Roadmap – Partnerships take time to build, so your IPP should be based on where the company is going in the future, not just the needs of today. You need to understand the company priorities and future shifts to the product, services, and geographical/territory roadmaps, which will impact how you prioritize your partners.

- Customer needs – Understand their pain points, challenges, and what drives their success at each stage of their lifecycle, e.g., Pre-Sale/Acquisition, Implementation, Adoption, Engagement, Expansion, etc.

- Partner Performance – Work with your ops team, or get your hands dirty in your CRM, to find trends that point to successful partners.

- Team Research – Speak to your top-performing Partner Managers about their best-performing partners,and what makes them great? Which partners do your sales/success/product team love to work with and why?

Phase 2: Prioritize

Now you have collated your research, you will likely have begun to connect the dots between Executive Expectations, Customer Needs, and Company Roadmap.

The flow of prioritization should follow:

Goals:

These are built from your Executive Expectations.

Biggest Opportunities:

These are built from the Customer Needs and must contribute to your goals.

Challenges to Avoid:

These are built from the Company Roadmap.

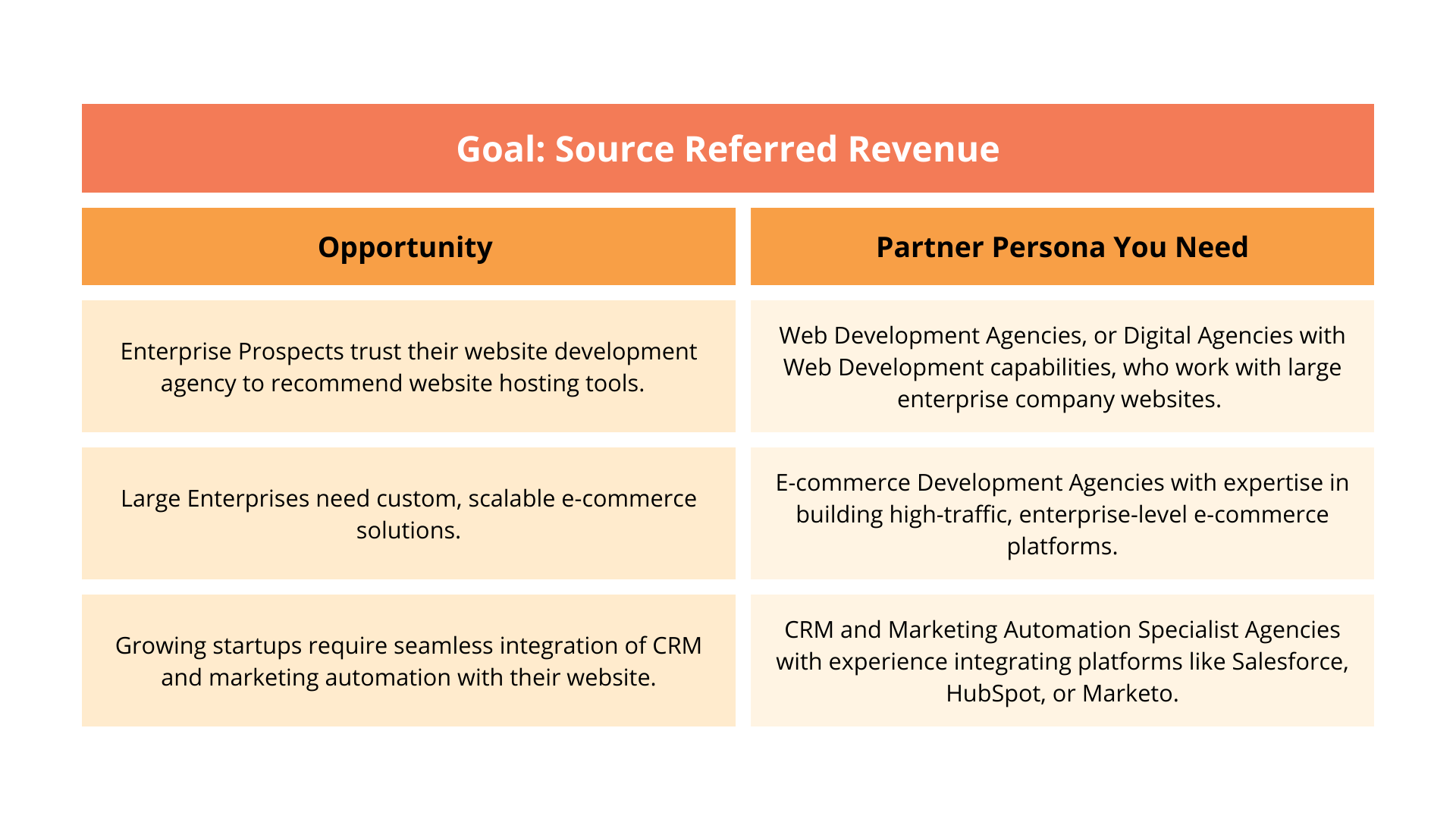

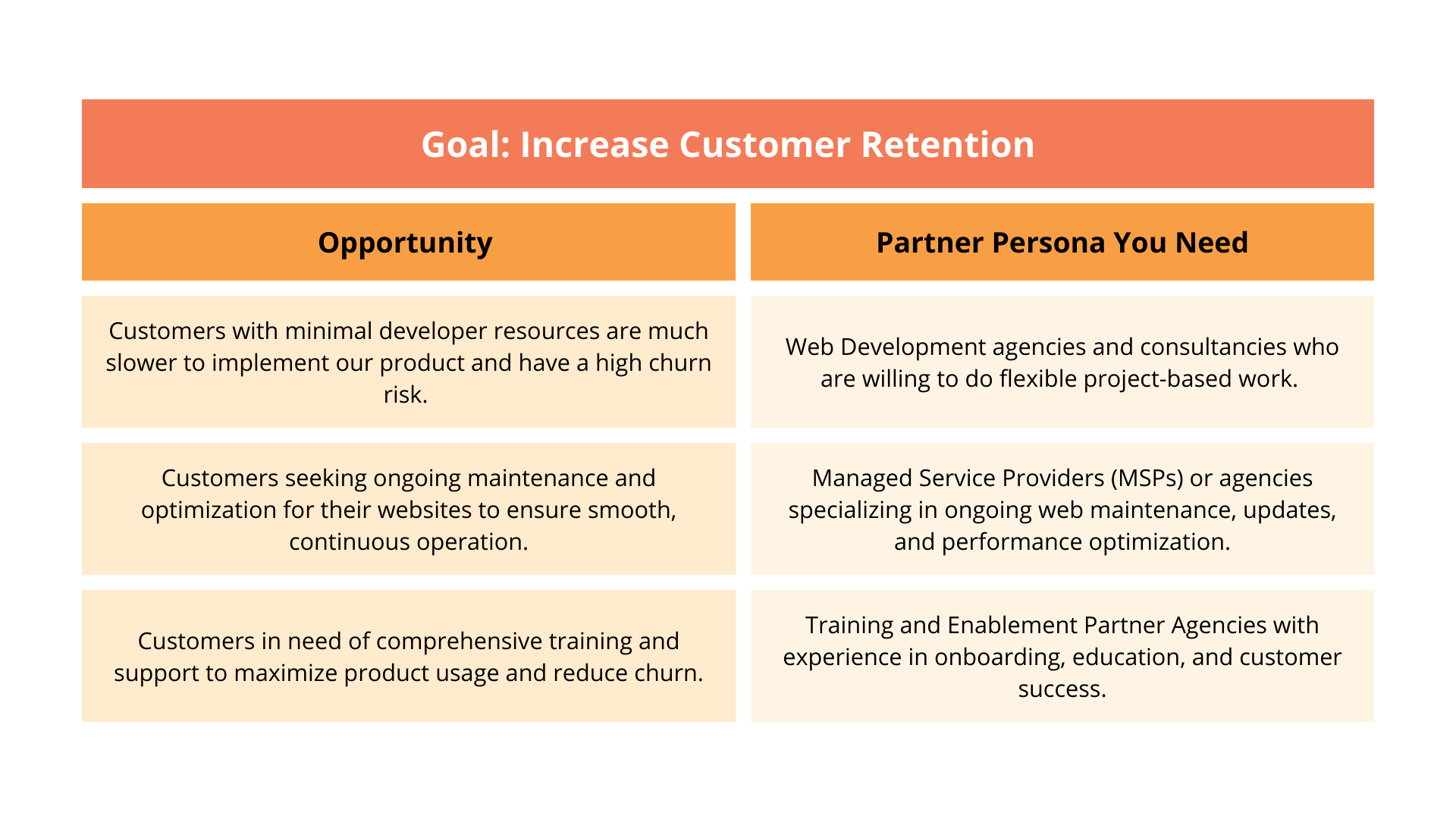

Phase 3: Build Your MVPersona

Provided that all of your opportunities match your goal/s, you can start to list the opportunities and identify the high-level partner persona/s you would need to capture the outcome.

Phase 4: Build Your IPP

Now that you’ve gathered all your research and done the prioritization work, it’s time to bring everything together into a clear and actionable Ideal Partner Profile (IPP). This is where the magic happens – you’ll create a profile that helps you pinpoint the right partners who align with your strategic goals and customer needs. By refining your IPP, you’ll establish a framework that focuses on partners who can drive real value and growth for your business. It’s also where your ideal partner personas come into play, and you’ll use a structured scorecard to evaluate potential partners. This ensures you’re targeting the right organizations, teams, and individuals to make a significant impact.

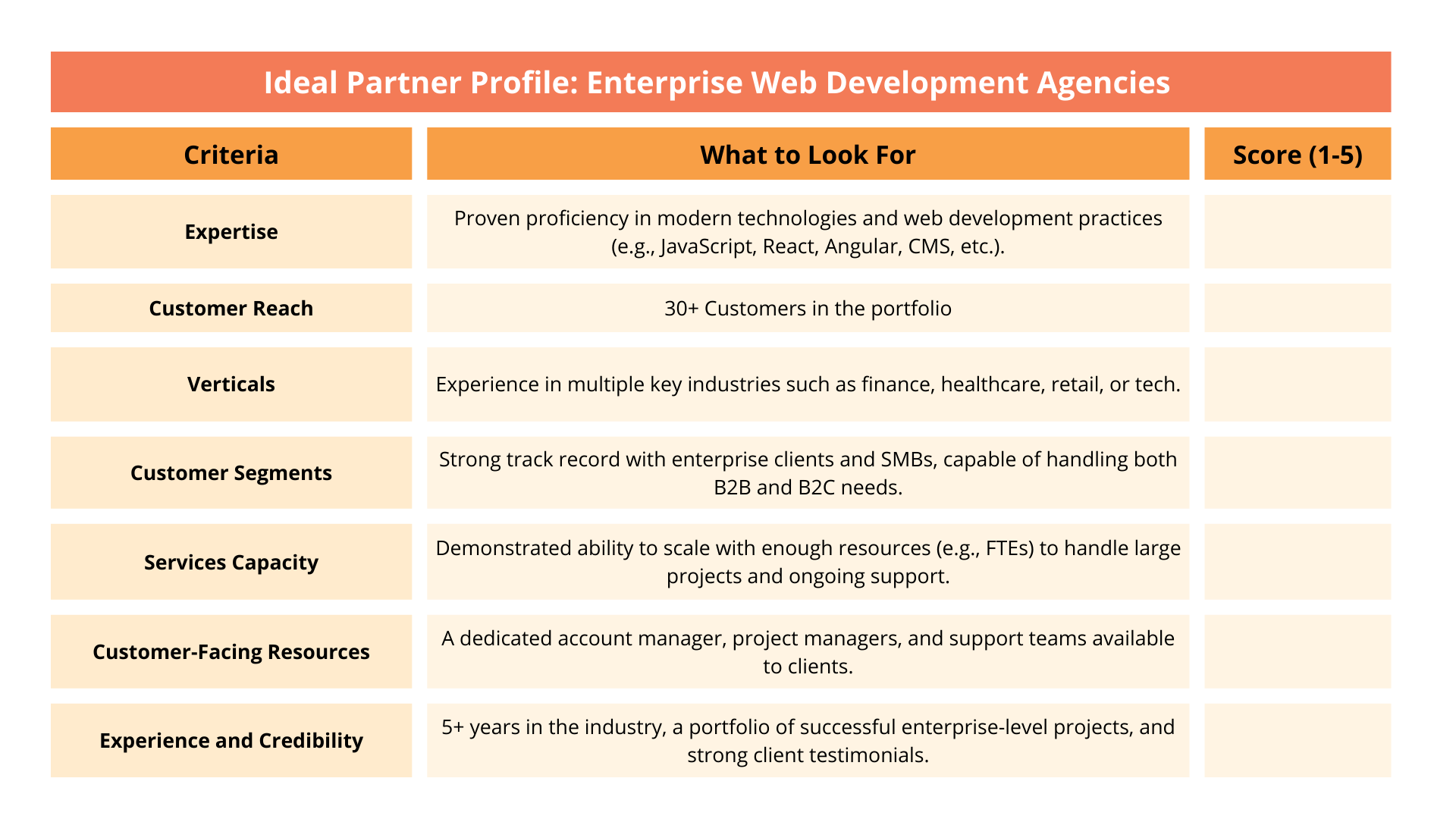

IPP Scorecard Template

It’s time to assess your potential partners. This scorecard will help you easily evaluate partners based on what matters most and keep things simple yet effective:

How to Score:

Score (1-5): Rate how well the partner fits your needs for each criterion, using a scale of 1 to 5.

- 1 = Poor fit

- 2 = Fair fit

- 3 = Good fit

- 4 = Very good fit

- 5 = Excellent fit

Total Score: Add up the scores to get an overall picture of how well the partner matches your Ideal Partner Profile. The higher the average score, the stronger the fit.

Potential Persona Variables/Criteria for Ideal Partner Profile:

- Customer Reach

- Number of customers (e.g., 30+ customers in their portfolio)

- Market reach (local, regional, national, global)

- Vertical

- Industries served (e.g., finance, healthcare, e-commerce, tech, etc.)

- Specialization in certain verticals (e.g., SaaS, manufacturing, etc.)

- Customer Segments

- Type of customers served (e.g., B2B, B2C, SMBs, Enterprises, Startups)

- Depth of relationship with customer segments (e.g., long-term relationships, loyalty)

- Services Capacity

- Available resources to scale (e.g., FTEs, team size)

- Ability to provide required services (e.g., implementation, ongoing support, technical services)

- Flexibility in handling project-based work or retainer-based models

- Expertise

- Proficiency in relevant technologies (e.g., JavaScript, CMS platforms, e-commerce solutions, etc.)

- Industry-specific expertise (e.g., experience working with specific verticals like finance, healthcare, or retail)

- Certifications or notable skills (e.g., certified developers, accredited consultants)

- Resources

- Availability of dedicated account managers, project managers, or support teams

- Communication, responsiveness, and quality of customer support

- Training, onboarding, or support resources available for customers

- Experience and Credibility

- Years of experience in the industry (e.g., 5+ years of enterprise-level experience)

- A portfolio of successful projects and case studies

- Client testimonials, references, or case studies that showcase their expertise and trustworthiness

- Partnership Maturity

- Level of engagement in the partner ecosystem (e.g., have they previously partnered with similar companies?)

- Ability to work collaboratively with external teams

- Understanding of the partner relationship model (co-selling, joint marketing, etc.)

- Cultural Fit

- Alignment of values (e.g., customer-first mentality, focus on innovation)

- Similar work ethic and business approach (e.g., speed of execution, flexibility)

- Approach to collaboration and communication (e.g., transparent, proactive)

- Technology Infrastructure

- Technical infrastructure available to support projects (e.g., tools, platforms, cloud capabilities)

- Integration capabilities (e.g., ability to integrate with your product, tech stack, or other partners)

- Security standards and compliance (e.g., data privacy laws, regulatory compliance)

- Financial Stability

- Revenue growth and business stability

- Profitability and sustainability of the business

- Investment in scaling their business (e.g., hiring, expanding services)

- Geography

- Locations served (e.g., global presence, regional expertise, multilingual capabilities)

- Ability to handle different time zones or specific regional demands

- Office locations and physical presence in key markets

- Scalability and Flexibility

- Ability to scale operations in line with growth demands

- Willingness to work on flexible or evolving business models (e.g., subscription-based, project-based)

- Experience in adapting to fast-changing customer needs

- Innovation and Thought Leadership

- Willingness to embrace new technologies or approaches

- Thought leadership in the industry (e.g., contributions to industry knowledge, publications)

- Ability to innovate on behalf of customers to stay ahead of the curve

- Pricing Model

- Flexible pricing or business models that align with your budget or go-to-market strategy

- Willingness to negotiate or collaborate on shared risks (e.g., revenue share, joint marketing investments)

Wisdom From The Experts

Andrey Lipattsev, Google

Partnerships and Product Manager

4 C’s of IPP

I’ve become a big fan of the 4 C’s framework from Franz-Josef Schrepf’s book. The model — Customers, Capabilities, Capacity, and Commitment — provides a powerful tool for evaluating partnerships and ensuring mutual success.

- Customers: Is there an overlap in customer bases between you and your partner?

- Capabilities: Does your partner have the necessary capabilities to meet your expectations and help you succeed?

- Capacity: Does your partner have the time, resources, and ability to dedicate to the partnership?

- Commitment: Can you count on your partner’s commitment to stay invested in the long-term relationship?

Also, ask yourself whether your value proposition aligns with your partner’s needs. What role do you play in the “better together” story? This framework, as outlined in the book, is a great way to ensure your partnerships are set up for success.

[Editor’s note: The 4Cs Framework was originally written by our good friend and the first-ever Partnership Leaders member, Nelson Wang]

Creating an Ideal Partner Profile (IPP)

An Ideal Partner Profile (IPP) shifts partnership-building from opportunistic agreements to strategic, value-driven relationships. This guide helps you develop an IPP that delivers results, not just looks good on paper.

Prerequisite I: Partner Hypothesis

Before creating an IPP, validate your strategy with a Partner Hypothesis. It defines potential partners, their motivations, strategic contributions, and roles. Only proceed to the IPP once the hypothesis confirms your partnership idea is viable.

Prerequisite II: Ideal Customer Profile (ICP)

An ICP, focusing on transactional relationships, differs from an IPP, which emphasizes long-term partnerships. Your ICP should be solidified before creating an IPP, as it provides the foundation for your partner profile.

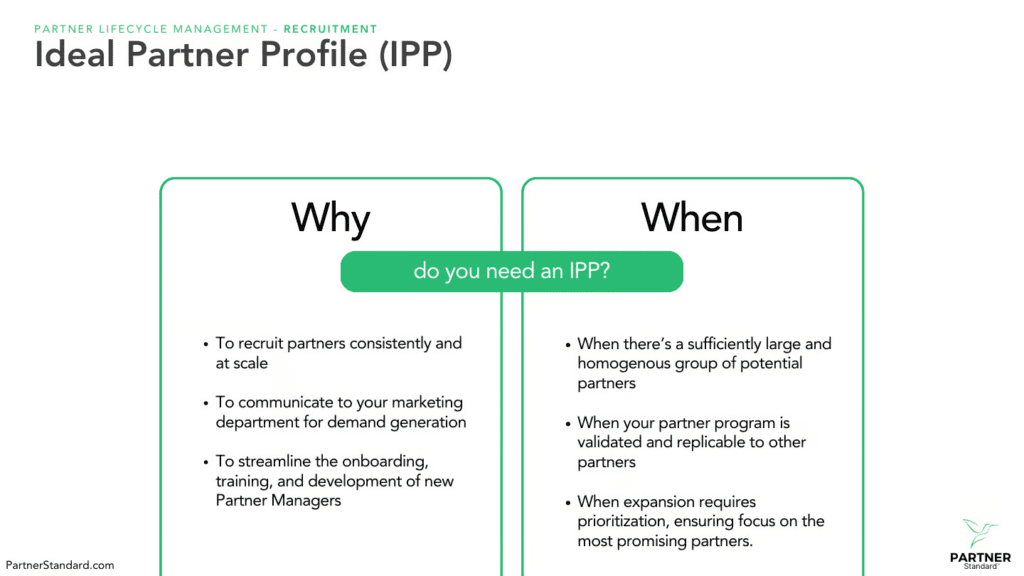

When to Create an IPP

Create an IPP once your product has market fit, your go-to-market strategy is proven, and your partner program is scalable. This is the right time to move from opportunistic recruitment to systematic program growth.

Components of an IPP

- Persona: Focus on the people driving partnerships—those with a collaborative mindset, strategic vision, and ability to succeed in long-term partnerships.

- Company Alignment: Ensure organizational factors align, such as strategic fit, go-to-market motion, operational compatibility, and cultural match.

Partner Categories and IPP Requirements

- Channel Partners: Evaluate their customer relationships and sales capabilities.

- Marketing Partners: Assess their content creation, market influence, and audience alignment.

- Product Partners: Focus on technical and vision alignment for seamless collaboration.

- Service Partners: Look for quality service methodology, expertise, and project management.

Common Pitfalls

- Avoid the “Perfect Partner” Trap by focusing on realistic traits that contribute to success.

- Regularly review and update your IPP to keep it relevant.

- Don’t let data scarcity hinder your IPP; create ways to assess partners with limited information.

Measuring Success

Key indicators include faster time to partner productivity, higher success rates, improved partner satisfaction, and efficient resource use.

Success Factors for New Partners

- Executive sponsorship for partnership facilitation.

- Experienced teams to navigate partnerships.

- A commercial fit in business models and pricing.

- Cultural compatibility.

- Operational integration.

- Complementary products/services.

An evolving, well-constructed IPP will strengthen your partner ecosystem and drive sustained business growth.

Check this article to know more about this: CLICK HERE

Barrett King, Ramp

Head of Alliances

Aligning with Customer Needs: Defining IPP and ICP

“IPP is a descriptive profile of a business and a way to identify if a partner may work with you. Qualification is their propensity to partner, be productive and drive impact (together).“

1. Align with customer needs first, and look at what businesses are nearby + already doing work for those customers.

2. Define IPP to include:

- Business Details (FTE, Services, etc)

- ICP at that IPP (all the acronyms)

- Impact partners drive clients

- Value Triangle

- Buy In

- Partner Value

- Sentiment

3. Do research and talk with actual prospects, vs assuming you know how to work best

- Revisit the profile often in your early days

- Framework at Ramp

- Company Type

- Tech Focus

- FTE

- ICP Titles

- Services Offered

- Target Account list research

- Initial Value Prop Assumptions

- Personas & Motivations

Lenka Brozmanova, FaceUp

Head of Technology Partnerships & Channel Marketing

Defining the Ideal Partner Profile (IPP): Criteria for Channel and Technology Partnerships

At FaceUp, defining an Ideal Partner Profile (IPP) depends largely on the type of partner—channel/service partners and technology partners require different criteria.

1. Channel Partners (Resellers, Referral, and Distribution Partners)

For channel partners, the focus should be on:

- Company Size & Market Presence

- Ensure the partner operates in a market that aligns with your geographic expansion strategy and targets the same type of persona.

- Evaluate their client base’s size and ability to drive revenue at scale.

- Service Alignment (Non-Competing but Complementary)

- The partner’s services should support your mission and be relevant to your target audience without directly competing.

- Ideal partners should enhance the value proposition of your software rather than create conflict.

- Sales & Distribution Capabilities

- Assess their ability to sell, market, and provide ongoing support for your solution.

- A strong sales enablement infrastructure (including trained sales reps, a defined customer success process, and industry expertise) is a plus.

- Reputation & Trust in the Market

- Partners should have a good reputation and credibility in their industry to ensure a positive brand association.

2. Technology Partners (Integration & Strategic Tech Partnerships)

For technology partners, the criteria shift to a more strategic product, technical, and go-to-market (GTM) Alignment:

- Geographic & Market Alignment

- The partner’s market focus should overlap with yours (similar regions and industries).

- Their customer base should align with your Ideal Customer Profile (ICP).

- Joint Customer Base & Potential for Co-Selling

- The more shared customers you have, the more proven value and demand exist for the partnership.

- The ability to expand adoption within existing customers is a strong success indicator.

- Product & Audience Fit

- Same target audience: Partners should target similar company sizes (SMB, mid-market, or enterprise) and industry verticals.

- Non-competing product/module: The partner should not offer a competing product or functionality that directly replaces yours.

- Integration Readiness & Technical Maturity

- The partner should be API-friendly, have a well-documented integration framework, and be willing to co-invest or provide support in building and maintaining integrations.

- Their product team should be supportive and capable of technical collaboration.

- Marketing & Sales Collaboration

- The partner should be willing to jointly market the integration through co-branded campaigns, marketplace listings, and mutual customer webinars.

- Their sales team should be enabled and motivated to promote the partnership, potentially through mutual GTM initiatives.

- Revenue & Business Model Fit

- There should be a clear understanding of revenue-sharing models or cross-sell/up-sell potential.

- If the partner has a marketplace or revenue-sharing model, it should align with your business goals.

Jason Lawson, B2B CoLabs

Founder

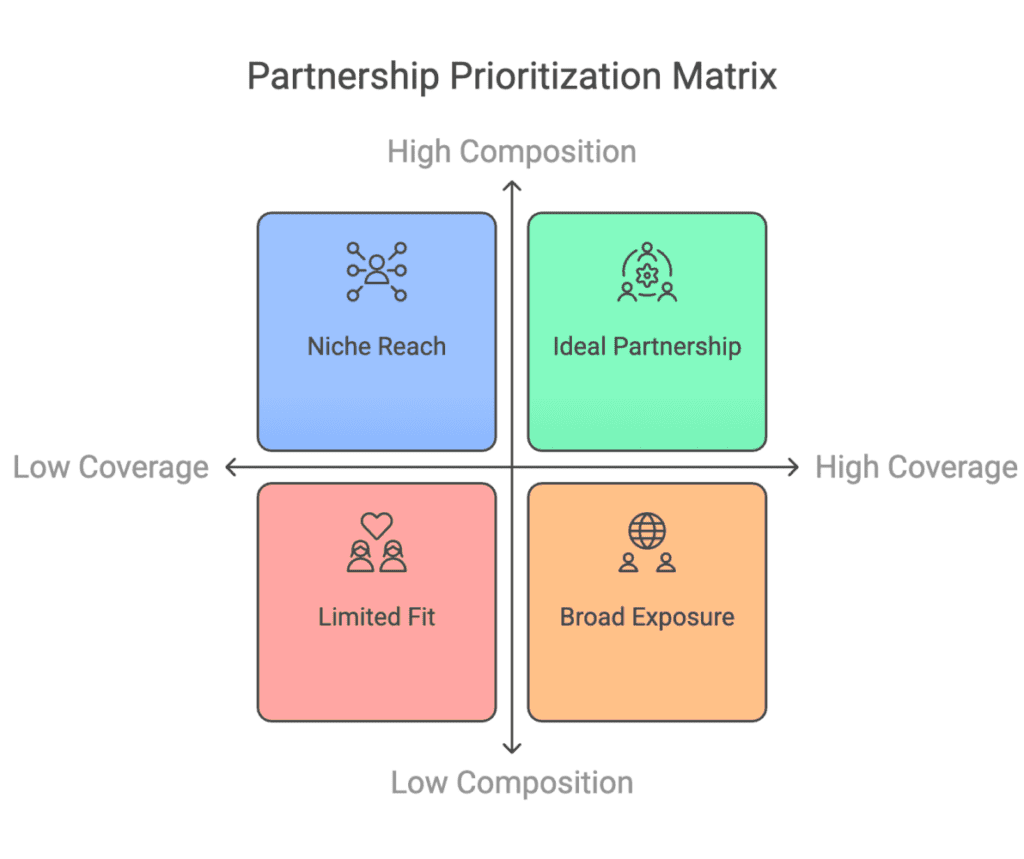

The Composition & Coverage Framework

Most B2B SaaS companies struggle with partnerships.

Not because they lack partners, but because they lack prioritization.

Too often, companies:

❌ Chase “big name” partnerships that bring zero pipeline.

❌ Spread resources thinly across too many low-impact partners.

❌ Assume co-marketing = co-selling (it doesn’t).

The reality? Not all partners are equal. Some drive high-intent leads and accelerate deals, while others drain time with little return.

That’s why I created the Composition & Coverage Framework, a structured way to evaluate which partners move the revenue needle:

If you’ve ever wondered:

➡️ Which partners deserve my focus?

➡️ How do I ensure partnerships generate pipeline, not just vanity metrics?

➡️ How do I measure partner impact?

This framework will give you clarity. Plus, it’s simple to deploy!

Check this article to know more about this: CLICK HERE

Maurits Pieper, Dixa

Director of Partnerships & Business Development

Team Compatibility for Scalable Partnerships

One variable that I like to look at is team and collaboration compatibility. As a partner manager, we always want to find ways where we are not a bottleneck to the collaboration between my GTM team and that of the partner.

In many cases, I want to find a partner that has a team of AM/CSM/Product/Marketing that matches how my team works. The better the match there, the more scalable the program, the less handholding, and the less of a bottleneck the partner manager.

Rick Flores, Partner GTM Hub

Principal

GROW Framework

“I see the IPP as a narrative. The Qualification Criteria is objective.”

How to GROW Your Partner Ecosystem?

Your Ideal Partner Profile is only as strong as its alignment with your Ideal Customer Profile. Too often, companies onboard Partners based on brand recognition or gut feeling, only to see little impact on revenue.

That’s why I developed GROW, a simple yet powerful framework to identify and evaluate the right Partners for your business:

🟢 G – Go-to-Market Fit

🟢 R – Resources

🟢 O – Outreach

🟢 W – Willingness

I break it all down in my latest article. Check it out here: LINK

Marc Gawith, Pictory

Head of Business Development and Sales

Choosing the Right Technology Partners for Growth

At Pictory, we look for Technology/Integration partners first, and with the priority in mind, we take a few things into consideration.

- What other solutions are our ICP customers using in conjunction with our own? Pictory is one part of the video creation/editing journey, so where are they hosting the videos, how are they managing the videos, and what companies make sense to partner with?

- Who is our ICP, and what companies/potential partners are also trying to gain mindshare with them? As an example, we work with many L&D professionals, so what solutions (LMS platforms, course creation solutions, etc.) are needed?

- What partners do we already have, and where can we partner with other similar companies, but where we aren’t in direct competition with our current partners?

The sales/adoption process is longer with these types of partnerships but the upside and growth potential are huge, and the stickiness factor is through the roof.

Sonia Groff, Hubspot

Principal Program Manager, Partner GTM Strategy

PACT Framework

At HubSpot, we are using the PACT framework:

P: Profile (Partner Profile)

A: Alignment (Strategic Alignment)

C: Customer (ICP)

T: Technology (Tech Stack)

Partner Profile: This includes the ideal partner size you are looking for, the services and products they provide, and their process / OM for marketing planning, sales opportunity management, SaaS implementation, change management, and customer lifecycle.

Strategic Alignment: Does the partner have an executive sponsor/business champion who will drive alignment top-down? Are they committed to building or expanding their HubSpot practice?

ICP: Does the partner have a mutual ICP? Do they target the same customer size, or are they industry-focused or generalist? What % of their revenue comes from new customers versus previously existing customers? (Internal Leadership should determine what this % should be!)

Technology: What is the partner’s experience level with marketing, selling, and servicing in the tools, apps, and platforms that are important to your company? Do they participate in other partner programs from your competitors?

How we use the IPP Framework:

This is a best practice guide for our partner acquisition team

Partners are not required to perfectly fit the profile to move forward in the acquisition process, especially considering regional nuances. But they should fit the big ones, like having an executive sponsor and meeting the employee size criteria

In the future, we will develop a scorecard based on this framework to allow us to gather more data and better support our acquisition team when it comes to targeting key partner accounts.

Andreas Krause, Hygraph

Senior Partner Manager

Evaluating and Evolving the Ideal Partner Profile (IPP)

First, we start with a High-Level Approach which includes:

- Target Audience: How huge is the overlap?

- Offered Products/Services: Do they offer products/services that complement ours?

- How well do both companies align in terms of goals/values/technical requirements?

- Do partnerships exist between the same ecosystem and competitors?

In general, we differentiate between Solution and Technology partners.

For Solution Partners, we look out for:

- Company size and competition, e.g., Boutique Agency vs. GSI – number of employees, developer ratio

- Covered Geographics

- Persona – Role Description

- Technology Maturity

- Offered Services

- Partner Potential

- 3 C’s (Capabilities, Capacity, Commitment)

- Willingness to work with us, not to entrench with our competitors

- ICP overlap

For Technology Partner, it is a bit more simplified:

- Have mutual customers in ICP Geos

- Use case fit

- Category match within the ecosystem

- Sales presence: Min. number of sales reps.

- Track record of partner marketing

- Use account mapping tools (e.g., Crossbeam)

It is fair to say that the IPP is just as strong as the ICP.

If the ICP gets reworked, you always have to check if and how you have to adjust your IPP. The ICP can more easily be replaced as the IPP, as the relationships you are and have been building can’t be switched just like this. This is always important to take into account from the beginning.

Furthermore, the IPP also has to be adjusted with the increasing maturity of the product and company. E.g., at the beginning, you might aim more for smaller agencies, later you can take on the bigger agencies, and consultancies. Working with GSIs is a different league. However, you should know what you aim for and keep this as a north pole.

If the product changes or gets additional functionalities, that might also address a different target audience, this might also be the time to check if you have to change or widen your IPP.

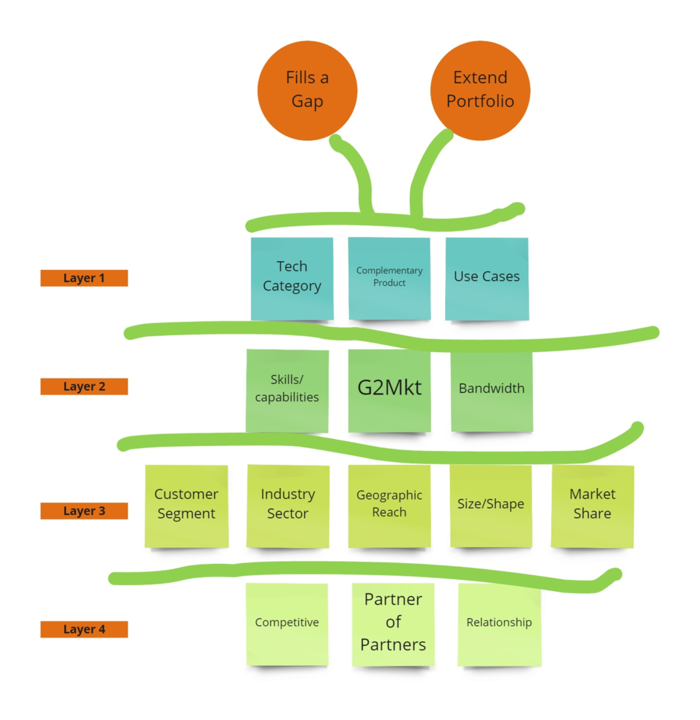

Kathie Osborne, Infobip

Director Partner Program, Digital Agencies

Key Attributes of an Ideal Partner Profile (IPP)

We see the Ideal Partner Profile (IPP) as a ‘set of attributes’ designed to meet the needs of the partnering scenario and used at the identification and recruitment phases.

There is typically a set of attributes that are common across IPPs. You may start with one attribute as a primary one, with the others used as secondary or follow-on attributes. Some attributes are given weighted scoring so that long lists of potential partners can be shortlisted.

To decide what attributes are important for the partnering scenario, ask yourself the question “I am looking for a partner who (is, does, has, will, won’t) ….”

We are looking for a [partner type e.g. ISV] who:

- are experts in an area where we have a gap (across product, use case, customer segment, industry sector, geography), and want to extend their portfolio

- is an expert in a Technology Category or Business Application

- has a complementary product or solution

- Can service use cases that suit our product set and/or our product roadmap

- has the skills and capabilities to undertake integration

- has a product/solution on another Marketplace

- has the bandwidth to undertake integration and GTM (willing/able)

- has a similar set of target customers or can reach a customer segment we cannot reach

- has a similar set of target industry sectors or can reach an industry sector we cannot reach

- has a presence in the same geographies or can reach a geo we cannot reach

- is not competitive and/or is not partnering with our competitors

- partners with our Technology Alliance partners/partners with our Channel partners

- is a certain size and shape (not too big, not too small)

- is already a customer or partner of Infobip

- has a recognizable brand/market share

Bryan Nugent, EPAM Systems

Senior Alliances Manager

Assessing Partner Profiles and ICP Alignment

- Partner profile. What are they doing?

- ICP match? Enterprise, SMB, etc.

- How do they complement your product or service?

- How much support is coming from both partner executives?

- Will they meet?

- Will they support the long-term play?

- Technical integrations? Needing tech support. Will resources be given?

- Sales enablement on both sides?

- QBR? Or bi-annual meetings?

- Realistic goal setting.

- Mapping the customer and prospect lists used tells very quickly if they are in the same ICP.

- 5-20 overlaps are ok. 100+ means they go after the same customers as you.

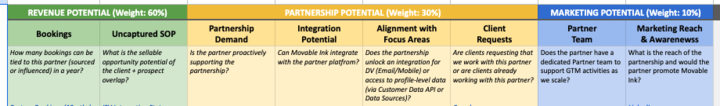

Kyle Schroeder, Movable Ink

VP Global Partnerships

Scoring and Evaluating Partner Potential

We don’t spend a ton of time recruiting new partners, but instead are invested in going deep with our current partners. That is largely guided by existing shared partner ARR, potential partner ARR, the number of prospects they have, willingness to partner, etc.

That being said, we’ve used a scoring system before to rank partner potential. Each of these has a high/medium/low, and then we map scoring against it. We always leave room for adjustments and modifications at the discretion of partner leadership if there is potential not fully realized in a scoring system like this.

Andrea Cerna, FaceUp

Chief Business Development Officer

Data-Driven Approach to Defining Ideal Partner Profiles (IPP)

Currently, we define our Ideal Partner Profile based on a structured, data-driven approach that identifies the most valuable partners based on real business impact. However, it has not always been like that – in the beginning, it was just an unstructured and unfocused approach based solely on assumptions, BUT we were not completely wrong.

So here’s how we do it for our two main partner types:

Value-Added Resellers

Phase 1: Broad Partner Acquisition

- We onboarded over 200 partners in the first year.

- Around 30 became active partners, bringing in some level of business.

- Out of those, 8-10 stood out—closing bigger deals, engaging closely with clients, and consistently generating revenue.

- The more clients used FaceUp, the more revenue these VAR partners generated—not just from selling FaceUp but from the additional services they provided.

- These 10 top partners weren’t just reselling FaceUp; they were bundling their own services into a full package for clients, making FaceUp an integral part of their offering.

- Their revenue model was threefold:

- Selling bundled services, basically a full-fledged package.

- Generating more revenue from ongoing client work that FaceUp enabled (often at an hourly rate).

- Earning revenue share from FaceUp subscriptions.

Phase 2: Identifying the Winning Traits

By analyzing key data points—Annual Contract Value (ACV), Average Deal Size, Sales Cycle, and other data we are leveraging, as well as the number of deals directly sourced and influenced by partners—we identified clear patterns among our top 10 VARs:

- They were already offering complementary services that aligned with FaceUp, making it an easy upsell that also expanded their revenue streams through ongoing client work.

- They had an active client base that typically had compliance programs in place but lacked a whistleblowing solution—a largely untapped market.

- Their business model benefited from multiple revenue streams, including recurring revenue from FaceUp subscriptions and revenue share, reinforcing long-term engagement.

- They operated in specific territories where FaceUp lacked a direct sales presence or where interest in whistleblowing solutions was growing due to new legislation or regulatory trends. These market conditions made it strategically beneficial to enter these regions through strong local partners.

Phase 3: Defining Our Ideal Partner Profile

Once the top-performing 10 partners became clear, a final pattern emerged—they shared common attributes beyond just business performance:

- Company Size & Growth Stage – These partners were at a specific stage of growth where they had the capacity and motivation to expand their service offerings.

- Strategic Goals – Their long-term objectives are aligned with FaceUp, seeing our platform not just as a product to resell but as an integral part of their business.

- Time & Resources – They had the bandwidth to actively engage with us and dedicate resources to joint success.

- Trust & True Collaboration – Most importantly, these partners didn’t just sell FaceUp—they built FaceUp with us. They became part of our team, contributed valuable feedback, and actively influenced the direction of the platform. The mutual trust and shared vision made them not just partners but true stakeholders in our journey.

Technology Partners

For tech partnerships, our approach was more organic and required continuous data collection:

Phase 1: Passive Data Gathering

- For the first year, we primarily relied on our sales teams to track what tools and platforms our clients were using.

- We leveraged tools like Avoma and other AI-driven solutions that automatically flagged whenever clients mentioned a specific tech stack in meetings or conversations.

Phase 2: Prioritization & Pre-Approval Strategy

Each quarter, we followed a structured approach to tech partnerships:

- Identify the most mentioned tech platforms from sales call insights.

- Select the top candidates with the highest potential for synergy.

- Seek pre-approval before making an actual integration to ensure strategic alignment.

Phase 3: Defining Our Ideal Partner Profile

We apply the same methodology to tech partnerships. While the process differs, the goal remains the same: identifying the most valuable partnerships based on real impact. When identifying most valuable tech partners, we focus on those with:

- High customer demand (measured by direct mentions and client feedback)

- A strong ICP overlap with FaceUp

- Clear customer benefits from the integration

- A strategic cooperation model beyond just tech alignment

We categorize our partners in different ways, and the description below is one of them. This is the version we share externally to outline the type of partners we’re looking for. Internally, our team uses a separate set of qualification criteria—structured as a checklist or Yes/No questions—to assess whether a potential partner meets our requirements.

We are looking for partners that align with the following criteria:

- Business Maturity & Revenue: Less than 8 years in the business, with a revenue of up to $5 million.

- Geographical Presence: Based in Spanish-speaking LATAM countries, Canada, the UK, Australia, New Zealand, or the United Arab Emirates.

- Client Base & Growth Potential: Already cooperating closely with at least 50 clients, actively providing services, and eager to connect with at least 30 more clients to expand their reach.

- Business Mindset: Actively seeking new business opportunities, open to joint marketing initiatives, attending local events, and engaging in industry discussions.

- Expertise in Whistleblowing & Compliance: Well-versed in local regulations related to whistleblowing, compliance, and governance, ensuring businesses adhere to legal and ethical standards.

- Company Size: Smaller Companies (up to 20 people) or Individual Professionals Specializing in Compliance, Legal & Investigation

Services They Can Offer (at least one, ideally more):

- Whistleblowing Report Management – Acting as an independent third party to manage and review whistleblowing reports with neutrality.

- Internal Investigations – Conducting unbiased investigations into reports of misconduct, fraud, harassment, or discrimination.

- Policy Development – Creating compliance frameworks, codes of conduct, and whistleblowing policies.

- Consultancy – Advising companies on legal and regulatory compliance (e.g., GDPR, SOX, ISO 37001).

- Audit Support – Assisting organizations in preparing for regulatory audits or compliance certifications.

Our ideal partner believes in transparency, integrity, and ethical business practices. They understand the critical importance of a speak-up culture and are passionate about protecting whistleblowers and fostering an environment where reporting misconduct is safe, encouraged, and valued.

Kristin Brown, Contentful

Director/Head of Partnerships EMEA & Asia

Criteria for Evaluating Solution Partners’ Fit with IPP

We have defined the following criteria to determine whether a partner fits our IPP. This is for solution partners:

- size (to understand capacity), e.g., 150 people min.,

- matching their ICP (revenue and industries) with ours

- team (do they have a sales team for proactive outreach)

- commitment (what does their competitor portfolio look like, are we one of many, or is the partnership more strategic)

- tech portfolio (do their existing solutions go well with ours)

Further down the line:

- enablement (are they investing in us)

- marketing (do they have a marketing person and budget)

- Have they built offerings and accelerators

- scorecard of criteria and partners, and scale from 1-5 to determine tiering

Brett Orlanski, ConceptCraft

Vice President, Sales and Business Development

Building ICP with Concentric Circles for Focused Targeting

I tell my team and clients to define their ICP by thinking of concentric circles. Start narrow and then slowly radiate out as you saturate the inner circle. Start by being overly specific and focused.

- Reimagine your ICP as an MVP (minimally viable product) but as a customer.

- Define the absolute least the client must have or do while still meeting your criteria of the ICP.

- Strip away all must-haves or nice-to-haves when mapping an ICP to your inner circle of customers.

- Look for success patterns in the inner circle, what makes these customers work for you, and then expand the next circle in that direction.

For example, if your product is a SaaS marketing platform, who is the ICP?

Ask yourself, is my product good for clients who are:

- Web, mobile, or both

- Brand, direct response advertiser, or something different

- Large, medium, or small advertiser (measured by budget)?

- Active advertiser or prospective advertiser?

- Does geo or location matter

Gather the least the client must have, for example: web only, direct response only, medium size, active spenders, and US only, and build a hit list of clients with those minimal criteria.

Then, right-size your TAM by focusing on ARC: Assumption, Research, and Competitive Analysis.

Manishi Singh, Spryker System

SVP Ecosystem and App Composition Platform

Aligning IPP with ICP: Key Partnership Criteria

IPP should closely reflect our ICP. Our definition of a particular market segment, e.g. Enterprise, should match.

There are exceptions where we will take a partner not yet focused on our ICP with us if their offerings complement ours.

- Regional Presence – Willingness to work with us in our focus regions and willingness to take us with them in our non-focus ones

- Culture – Agile, Easy to work with, Collaborative. I believe these are very important

- Attitude Towards Us – Especially since we are a smaller company

Mario Joao, Prometheus Group

Interim – Strategic Partnerships Leader

Core Partner Categories

Prometheus Group seeks to build strategic partnerships with companies that align with its mission of enhancing enterprise asset management (EAM), maintenance, and master data management within ERP ecosystems.

a. ERP Providers (Strategic Platform Partners)

- Key Players: SAP, Oracle, IBM, and other major ERP vendors.

- Role in Ecosystem:

- Enable deeper integration between Prometheus Group solutions and ERP systems.

- Support ERP-driven innovation in asset-intensive industries.

- Provide certification and marketplace opportunities to expand solution reach.

b. Hyperscalers (Cloud & AI Infrastructure Partners)

- Key Players: AWS, Microsoft Azure, Google Cloud.

- Role in Ecosystem:

- Enable cloud scalability and AI-powered data management for Prometheus solutions.

- Offer co-selling and joint innovation opportunities to accelerate digital transformation.

- Provide security, compliance, and industry cloud solutions for EAM and master data.

c. Global System Integrators (GSIs) & Advisory Partners

- Key Players: Accenture, Deloitte, Capgemini, TCS, PwC, and other leading GSIs.

- Role in Ecosystem:

- Implement, customize, and integrate Prometheus solutions into large enterprise environments.

- Lead ERP migration, transformation, and optimization projects.

- Drive large-scale adoption of Prometheus solutions through managed services and advisory.

d. Technology & Data Partners (Solution Innovators)

- Key Players: ISVs and data analytics providers specializing in industrial automation, AI/ML, IoT, and cybersecurity.

- Role in Ecosystem:

- Extend Prometheus Group’s capabilities with AI-driven master data management, predictive maintenance, and asset optimization (just a few examples)

- Deliver industry-specific enhancements to Prometheus solutions.

- Support seamless interoperability through open APIs and cloud integrations.

Ideal Partner Characteristics

Ideal partners share the following attributes:

- ERP-Centric & Industry-Focused: Deep expertise in enterprise asset management, maintenance, and operational efficiency within asset-intensive industries.

- Cloud-First & AI-Enabled: Committed to leveraging cloud, AI, and predictive analytics to drive efficiency and intelligence in asset management.

- Go-to-Market Aligned: Open to OEM, resale, and co-sell models, with established enterprise customer relationships.

- Scalable & Integration-Ready: Able to seamlessly integrate with Prometheus Group solutions and align with ERP and hyperscaler ecosystems.

- Strategic Growth Mindset: Willing to invest in joint innovation, enablement, and multi-year collaboration for mutual growth.

Building an Early-Stage Partner Program with Simple Metrics

For brand-new programs, I always start with our customers:

- What help do they need that we don’t cover?

- The type of organization they call for help

- type of skills/expertise

- time spent on the platform vs the customer

- Look up users of your platform on your customer accounts with a different email domain

- Interview dozens of #1 and #2 above. #2 might be your very first partners

- Early litmus test: do the service providers show signs of “I’ll use whatever my customers want to use”

- yes –> dump

- no –> Are we moving the needle for your business? want a take?

Again, for early-stage programs, it doesn’t need to be more sophisticated than that as you need your first partners to build your data set. That said, start measuring:

- referrals/month (vs average)

- sales/month (vs average)

- ASP (vs all partners’ average, and company average)

- onboarding cost (hours, etc)

Simple metrics that will help you sort out the top, mid, and low ranges within 6-12 months. By then, you have the beginning of an IPP.

Sam Kreimier, Defense Unicorns

Partnership Manager

ICP to IPP: Key Partnership Fit Criteria

Just a few things to consider when identifying if it is a good match:

- Mapping to our ICP:

- What organization?

- What is their budget?

- What is the mission focus?

- What are their key challenges?

- Who is the decision maker?

- The IPP should have a direct overlap with ICP:

- What industry?

- What type of partner?

- What does the overlap look like?

- How does maturity come into play?

- What is the competitive overlap?

- How does this scale?

Daniel Sandler, Typeform

Head of Partnerships

Key Characteristics of Ideal Partners

Key Characteristics:

- Mutual Offering: Specialized in providing mutual offerings that align with our customers’ use cases.

- Value-Added offerings: Ability to provide clients with actionable insights and recommendations based on data collected through Typeform.

- Client Portfolio: A diverse portfolio of B2B and B2C clients, particularly in industries like SaaS, tech, professional services, and e-commerce. Then, looking at overlap, if we have a good amount of current overlap, then there is likely a partner activation we can do.

- Alignment with Typeform’s Mission: Committed to delivering solutions that enhance user engagement and customer experiences.

Michael Doherty

Channel and Partnership Advisor

Ranking Providers for Revenue and Business Impact

You can typically find out what technologies or platforms your existing customers use in their business and create a ranked list of providers that are prevalent within your ICP. Then, go and check out those providers’ partners, categorizing them by type (e.g., SI, VAR, MSP/MSSP, etc.). Apply a version of the litmus tests previously mentioned to rank them according to revenue opportunities, market share, and, most importantly, when starting from scratch, expected time to revenue. This includes business impact, willingness, ease of enablement, and client ownership. For example, a boutique specialist consultant or services provider may be prioritized over a company like SHI, even though SHI may have a larger TAM and upside on paper.

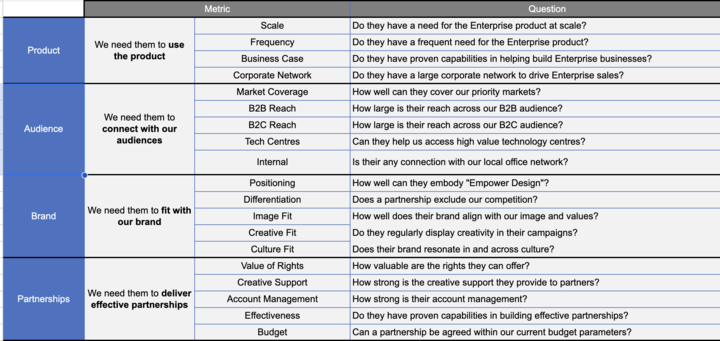

Yogi Gnanavel, Amaze

Director of GTM (Europe and India)

Partner Evaluation Criteria

We evaluate partners across the following criteria:

- Product

- Audience

- Brand

- Partnerships

- Brand association/positioning was a key factor when considering partners

Craig Gleason, PartnerIQ

Fractional Head of Partner Acquisition

The Importance of Upfront Work and Partner Alignment

One of the things we see all the time is the missed “upfront work,” ensuring you have enough information to develop your ICP (or multiple ICPs– which will be needed).

At PartnerIQ, we preach that you must clearly understand your company’s business goals (geographic expansion, new verticals, ARR growth, etc.), at which point, you can determine what types of partners are needed to impact those goals. For example, geographic expansion begs for resellers, whereas a top-of-funnel problem can be solved by referral partners. These decisions will dramatically impact what your ICP should look like.

For example, if you are looking for resellers in an existing market, you would lean more heavily on their sales acumen. If it’s a reseller for geographic expansion, your ICP might look different. Their ability to generate leads and deal with tier-one support becomes more critical.

I recommend outlining a scorecard of what’s needed from your partner community to support the overall company direction.

Ramin Azizli, Uberall

Senior Partner Account Manager/Senior Sales Person

How to Build an Ideal Partner Profile (IPP) in SaaS

Building strong, lasting partnerships isn’t about luck – it’s about strategy.

And at the heart of a successful partner program is a well-crafted Ideal Partner Profile (IPP) – a blueprint of an ideal partner fit that ensures alignment, value, and long-term success.

Why Does an IPP Matter?

Not all partnerships are created equal. You might team up with a company that looks great on paper – strong market presence, complementary product, enthusiastic leadership – only to realize a year later that your goals, customers, and ways of working don’t align. The partnership fizzles, costing time and resources.

That’s why defining an Ideal Partner Profile is crucial. An IPP isn’t a wish list; it’s a data-driven guide to:

- Who you should collaborate with.

- How to engage effectively.

- Why: The objectives and aims of these partnerships

Key Questions to Build an IPP

Before diving in, ask yourself:

👉 Are you launching a new partner program or refining an existing one?

👉 What type of partnership do you need – product, channel, operational, or else?

👉 Which attributes are must-haves vs. nice-to-haves, and how can you score them from least important to most important? (e.g., market overlap, technology fit, sales strategy, cultural alignment)

👉 How will the IPP fit into every stage of the partner lifecycle – from sourcing and onboarding to collaboration and potential separation?

Crafting a Strong IPP

Great partnerships thrive on shared goals, complementary strengths, and long-term commitment. Your IPP should be:

✅ Structured – Define clear selection criteria, scores, and KPIs.

✅ Data-driven – Use market insights, customer needs, and business objectives.

✅ Evolving – Adapt as market conditions and priorities change.

Final Thoughts

An IPP isn’t just about picking the right partners—it’s your North Star, guiding you toward scalable, revenue-driving partnerships. And remember, a static IPP is a dead IPP – it must evolve with experience, market trends, and business priorities.

Get Certified in Building IPPs!

Time to go beyond the basics. Our IPP Framework Certification course has practical tools and assessments to help you create the perfect Ideal Partner Profile. Whether refining your skills or starting fresh, this course puts you on the fast track to success. Ready to get certified? Let’s do this!

Step up your skills today: TAKE THE CERTIFICATION HERE