Updated: Nov 18, 2020

This article was guest written by Alexandre Popp, Field Sales Representative at Google Cloud

The article does not reflect the views of the writer’s employer. Rather, the central thesis of this article stems from 8+ years of leading alliance organizations at startups, and collaborating with consulting & technology partners at two of the three market leading cloud vendors.

Was it only yesterday that Techcrunch would regularly report the birth of a new unicorn, calling for eye watering valuations despite historical year over year losses? Profitability was scorned in light of a Gekko-esque hunger for revenue and net new customer acquisition. Alas, Covid-19 took the punch bowl away, waking up startups to the realities of profit and loss statements. To get back into the black, SaaS startups, or digital natives, have doubled down on a few key initiatives: cut costs, increase pipeline coverage due to slowing conversion rates, reduce churn, and increase upsell (as net new customer acquisition strategies face an uphill battle in the face of freezing budgets).

Against this backdrop, digital native C-level executives should explore new avenue in the hope of doing more than just steady their ship. Indeed, most startups overlook that their most strategic vendors — the stalwart cloud providers — could by that same token be their most strategic growth channels. AWS, Microsoft, Google Cloud are the stewards of vast customer ecosystems, and have incentives to promote digital natives’ solutions within those communities, as their customers consistently ask them for recommendations of industry specific solutions. Consequently, this market dynamic opens up a partnership opportunity that digital natives should explore more keenly.

Why should a startup care about the cloud providers?

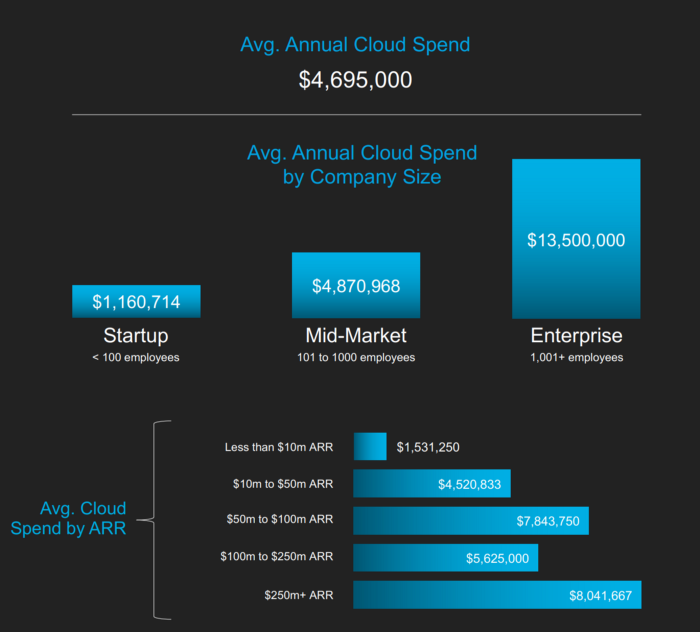

Before we explore how cloud providers can address your growth and cost concerns, let’s take a look as to why these players are relevant to startup SaaS vendors. Most post Series A startups write a significant monthly check to their cloud providers. The data backs that up: A recent report by Harness, a DevOps CI/CD provider, noted that 64% of digital natives with ARRs ranging from $5 million to $250 million leveraged two cloud providers. Only a minority (24%) were mono cloud. Interestingly enough AWS and GCP figure more prominently than Azure in the community. Startup spend, not surprisingly, climbs almost exponentially, with a median of $1.16 million for firms with less than 100, but climbing fast towards $5 million as they grow past that mark (i.e. as they get to Series B and C). Interestingly enough, most startups do not know what their cloud spend is as a % of their ARR. More fodder for the argument that startups might overlook the potential in their relationship with cloud actors — if you are spending millions of dollars a year on a single vendor, should you not be reflecting on the dynamic of that relationship a bit more proactively?

Image taken from Harness’ report. Digital natives with less than $100 million ARR see a cloud bill that quickly scales to the millions. Interestingly enough they were not aware of what that spend was as a % of their ARR, a cautionary tale for companies whose margin can be dangerously dragged down by their infrastructure spend.

At this juncture, take a step back and reflect on what a typical SaaS C-level leadership team cares about. Nowadays, a digital native CEO is most likely in regular conversations with the board on strategies to reduce costs and extend longevity (the Sequoia Black Swan memo captures the current zeitgeist). VPs of Marketing have to pivot and focus only on digital events in light of social distancing mandates. VPs of Customer Success are double and triple checking their onboarding and implementation playbooks as churn is probably now the most important sales metric. VPs of Sales… have a brutal mission to hit targets that probably need to be revisited. They too are pivoting to look at their install base for cross selling and upselling opportunities. To summarize, pipeline, customer retention, or simply put, setting oneself up to fight another day, are the strategies du jour. In other terms, the key performance indicators are marketing qualified leads, sales qualified leads, net retention rate, life time value of customer, average spend per customer.

Your interests are intertwined with your cloud provider as your growth begets theirs. In other words, there is a direct correlation between your growth and your spend. If your business slows down, or your products see dwindling adoption, that means your software sees lower levels of computing utilization. Your cloud vendor(s) will have an imperative to not only focus on your technical success, but these aforementioned business objectives as well; their self interest is synonymous to yours because if your business does not grow, neither does there.

What do the cloud vendors care about?

How can a cloud actor address a SaaS company’s metrics of success? Let us now dig deeper into what AWS, GCP, Microsoft care about in order to understand their own competitive pressures, which ultimately influence their motivations for supporting more attentively their startup SaaS customers.

The cloud vendors care about digital natives because these latter players enable AWS, GCP, and Azure to more broadly address a growing set of pain points that they cannot address by simply going alone. Indeed, the use cases and industries are so diverse that these vendors cannot go about building and marketing SaaS solutions all by their lonesome — they have to partner with third party digital natives to extend their reach into their customer base. For instance, is Microsoft an expert at healthcare? Not necessarily, but they do power third party software vendors that provide applications to securely store and share patient data with their attending physicians. Is AWS an expert in providing three dimensional visualization software? The cloud vendors have to partner in order to provide more choices to their customers and address a wide variety of use cases they cannot tackle by simply providing building blocks (infrastructure).

That being said, the cloud players nonetheless have to provide more than the computing building blocks to SaaS customers in order to differentiate their offerings amongst themselves for two main reasons. First, the managed services approach to many components of IaaS and PaaS will become commoditized over time (if they haven’t already, some would argue). A CPU and RAM configuration on one platform is the same on another, and thus cost increasingly becomes the differentiator. Even managed services for platform solutions like Kubernetes and database management that today seem differentiated over time will get commoditized, hence why AWS, Microsoft, and Google Cloud have to recruit SaaS digital natives: they need to move up the X-aaS stack to carve out distinct competitive advantages. Second, cloud providers have to do more than just provide the workloads because their startup customers are struggling in light of the current economic situation, and are looking for new growth areas.

What can the cloud providers do for a startup?

The support and partner programs that these vendors provide can realistically be the lifeline that some of these digital natives need. Indeed, AWS, Microsoft, and Google Cloud can all bring resources and programs to the table to proactively grow a digital native business. A few examples that come to mind:

Marketing development funds

These substantial dollar figures allocated to partner marketing activities, can be budgeted to specific digital natives as long as these players can quantitatively show the increase in pipeline and marketing leads.

Co-selling programs

If your yearly cloud spend reaches a certain threshold, GCP for instance will even embed you in the fold of a co-sell program whereby their sales teams can retire quota by selling your solution through their marketplace. GCP will do that proactively on her behalf, and that channel has a lower cost of acquisition since the marketplace revenue share agreement represents a lower cost of sales than having to pay a BDR and AE to open up and close a deal.

Incentives from the field to promote your solution to paying customers

Time to close is also reduced as enterprise customers who have a commitment in palace with GCP can draw that down by acquiring your solution through that same marketplace: saves you time from having to engage with their procurement to become a newly approved vendor. Additionally, because that end customer deploys the digital native solution in their cloud platform, churn risk is much lower.

Communities and network effects

AWS, Microsoft, and GCP all have accelerator programs that enable you to share knowledge, experience, and connections. In an increasingly digital and shelter-in-place world, genuine connections are harder to come by, and learning by osmosis can only be done via zoom nowadays. The cloud vendors can open up communities whereby your startup peers can at first become sounding boards and even perhaps your customers down the line.

So how do you negotiate with the cloud players?

As you gear up to engage in conversations with AWS, Microsoft, Google Cloud, keep in mind one of the main takeaways from the negotiation book Getting to Yes by Roger Fisher and William L. Ury. They discuss at large the concept of ‘Best Alternative to a Negotiated Agreement,’ or in other words, the anchoring of negotiation to a counterpoint that is less painful than the current agreement about to be settled upon. If that BATNA is too costly, then the deal in front of you is worthwhile.

Apply that logic when dealing with the cloud providers. Economically speaking, the cloud vendors look to sign multi year commitments. As cloud computing takes advantage of the pay-as-you-go model of on demand resources, agreeing to commitments is difficult especially if you are unable to forecast your fluctuating spend. But if you can, and you’ve optimized your spend, then that door becomes much easier to open. Usually the vendors will throw credits, funds, support as financial mechanisms to help reduce your TCO. Your best alternative to not signing such a commitment is to continue as before — and do as you’ve already done, as it’s gotten you so far. But if every one of your peers acts that way, could you be different? Can you leverage the commit conversation to follow through on all the aforementioned points as to construct a joint business plan that drives more consumption for the hyperscaler, and more revenue / net new customers to you? Better yet, can you truly be multi-cloud like some actors — and benefit from the best of two (or more) cloud partners? You have three channels to choose from; whether you can get one, or two, or all three to commit to you, that is now entirely in your hands.

Join The 1850+ Leaders Transforming Partnerships

As a member of Partnership Leaders you will:

- Build and learn with the top partner people at the best companies around the world.

- Increase your impact and accelerate your career with proven resources, tools, and best practices.

- Grow a network of peers, partners, and advisors with common objectives.